Power Your Business Forward

From SMEs to contractors, our tailored credit solutions keep your operations moving and your growth on track.

Apply For a LoanFast Loans, Zero Stress

Apply online and get quick, transparent funding with our digital-first process—money when you need it most.

Get A LoanFueling Entrepreneurs & Farmers

From working capital to agric input loans, we finance what matters most to help you grow, harvest, and succeed.

Apply NowSupport When Life Happens

Flexible salary-backed and personal loans for school fees, rent, medical bills, and emergencies—made simple.

Get a Loan NowWho We Are

About Pakasso Credit and Capital Ltd

We are a licensed Nigerian finance company committed to delivering timely, transparent, and technology-driven lending solutions. We operate under the Central Bank of Nigeria (CBN) regulations, offering ethical and secure credit services nationwide. Our mission is simple: to be your most trusted credit partner—helping you thrive, one loan at a time.

Our Services

What We Offer At Pakasso

Why Choose US

Pakasso Credit and Capital Ltd

At Pakasso Credit and Capital Ltd, we go beyond giving loans—we provide trust, speed, and tailored solutions that help individuals and businesses thrive. Our Vision is To be Nigeria’s most trusted and innovative credit partner—fueling sustainable growth for individuals and businesses. Our Mission To deliver accessible, affordable, technology-driven financing that helps clients achieve personal and business goals without friction.

- Licensed By CBN

- Flexible Repayments

- Customer-Centric

- Technology-Driven

- Experienced Team

- Strong Partnerships

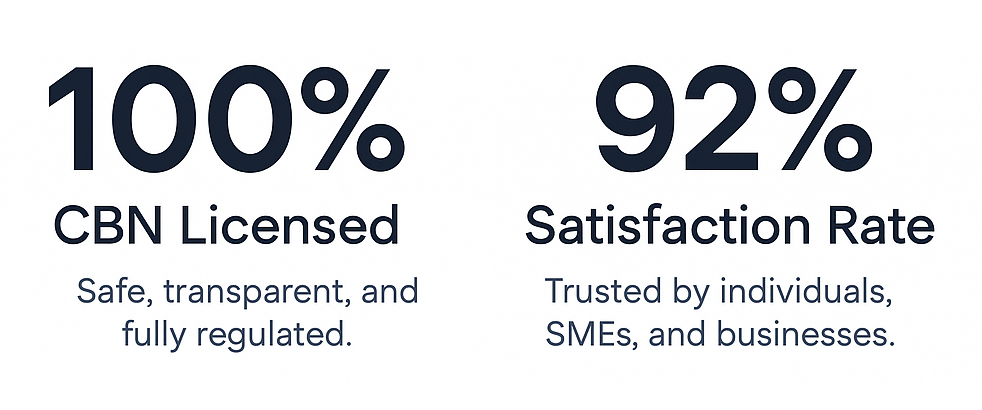

Why Nigerians Trust Pakasso

100%

CBN-Licensed & Compliant

92%

Satisfaction Rate

15K+

Applications Annually

10+

Years Of Experience

Get the cash you need, when you need it Get the cash you need, when you need it

How It Works At Pakasso

At Pakasso Credit and Capital Ltd, we make access to finance simple, transparent, and timely. Here’s our step-by-step process:

Apply online or at our branch with basic KYC details. Choose your loan product and preferred tenor.

We check your application for completeness, run a quick credit bureau consent, and assign a preliminary score.

We review your bank statements, analyze your cash flow, and verify collateral/guarantees. For trade and contract finance, site or anchor verification may also be required.

Our Credit Committee makes a decision. If approved, you receive an offer letter detailing loan amount, pricing, fees, and repayment terms.

Once agreements are signed and security is perfected (where required), funds are swiftly disbursed to you or your vendor.

Repayments are made digitally via direct debit, standing order, USSD, or payroll deductions. We also monitor portfolios and provide ongoing client support.

Eligibility & Documentation

Basic Requirements for All Loans:

Valid ID & passport photo, Proof of address, 6–12 months bank statements, Completed application form, Credit bureau consent.

Additional requirements depend on loan type

(e.g., CAC docs for SMEs, employer consent for payroll loans, proforma invoice for equipment finance).

Meet Our Team At Pakasso Credit & Capital

Leadership & Management

HRH Dr Becky Olubukola –

Chairman/president

Dr. Becky is a seasoned entrepreneur, strategist, and author with deep experience across real estate, construction, and media. She brings strong governance, visionary leadership, and enterprise development expertise to guide Pakasso’s mission of empowering individuals and businesses.

Olugbenga olaniyia –

Director of projects

Olugbenga oversees Pakasso’s project development and execution. With strong expertise in planning, coordination, and delivery, he ensures financing solutions are scalable, impactful, and aligned with client needs, strengthening Pakasso’s reputation as a reliable financial partner.

Gbenga Ademola –

Director of public Administration

Gbenga directs Pakasso’s public administration, managing policies, governance, and operations. His leadership ensures efficient service delivery, alignment with industry standards, and strong stakeholder relationships that drive sustainable growth, impact, and community development across Nigeria.

HRH Queensly uzoka –

Director of legal/ procurement

Queensly manages Pakasso’s legal and procurement framework. With expertise in corporate law, governance, and compliance, she ensures transparency, accountability, and regulatory alignment, providing secure foundations for the company’s financial operations and client.

Pst Ayodele loveth –

Director human resources

Ayodele leads Pakasso’s HR strategy, focusing on staff development, welfare, and organizational culture. Her leadership fosters professionalism and integrity, ensuring Pakasso remains client-focused while building a strong, motivated team to support long-term growth.

Our Dedicated team of professionals helping you access credit & loans with ease.

Testimonials.

Here are real stories from individuals, SMEs, farmers, and contractors who have grown with us (PAKASSO).

Applying for my loan was so easy. Within 48 hours, I had the money in my account. The process was clear, the staff explained everything, and I didn’t feel pressured with hidden charges. Pakasso really saved my business when I needed working capital.

Chinedu A., Fashion Designer (Lagos)

I used Pakasso’s payroll loan to cover my rent, and it came just in time. The application was quick, the approval was smooth, and repayment was deducted directly, no stress at all. It gave me peace of mind when I needed to use it the most for my business.

Grace O., Food Trader (Abuja)

Farming is seasonal, and Pakasso understood that. They gave me agric input finance with a repayment plan that matched my harvest cycle. I was able to buy seeds and fertilizers, and when the season ended, repayment felt manageable. It made all the difference.

Aisha Y., Farmer (Kano)

I’ve tried other lenders, but Pakasso stands out. They are transparent, professional, and truly care about their customers. Every step of the process was explained, and I never felt misled. I trust them with my future projects, both personal and business.

Amaka B., Entrepreneur (Lagos)

As a contractor, mobilization is always tough because projects need upfront cash. Pakasso financed my LPO, and I was able to buy materials, pay workers, and deliver on time without delays. Their support helped me keep my reputation strong.

Michael K., Contractor (Port Harcourt)

Our partners & sponsors